Do We Believe in the Millenials?

Starting a few years ago, I've been hearing a lot about how the Gen-Y or Millenials (people aged anywhere from 18 to 30 today) are going to change everything -- but particularly in real estate. A random sampling of opinions about how the Millenials will affect real estate, from a Google search I just ran, turned up these recent posts and articles: MILLENNIALS – The New Face of Real Estate:

Text messaging, email, IPods, Facebook and being mobile as ever is a part of the new generation, the Millennial. The Millennial are the young workers ranging in age between 21 to 29 years old. They have the potential to create a lasting change in the real estate workplace because of the way they live, communicate and more importantly, the way they view their jobs.

80 Million Reasons to start changing your marketing....Millennials.

What do you think , will typical marketing work to attract someone that is buried in a laptop, ipod, FB, Twitter etc.. and values friendship more than work?

“Real estate agents may wonder why they should care about the Generation Y age group, ages 18 to 30,” Jessica Lautz, a senior research analyst at the National Association of Realtors, wrote on the organization’s website in 2008. “These unique home buyers are the youngest of the home buying segment and are the most likely to purchase a home in the next two years in comparison to any other age group.”

Sustainability, Urbanity, and You: How Millenials will Change the World (and Architecture)

Millennials grew up in suburbia; bland environments dependent on others for mobility. They are entering the adulthood seeking lifestyle: vitality, diversity, and community. But, Millennials are not the only ones who will be driving this sea change from suburban to high quality urban environments. Baby Boomers will soon be retiring by the boat load. Retirement communities in their current form resemble warehouses more than they do the most desirable of retirement “villages”—real communities where retirees can be independent and empowered, such as the Upper East Side and Key West.

And so on and so forth. If you cared to, I'm sure you can find dozens, hundreds of other musings on the Millenials and how they force real estate professionals to be ever more online, ever more sensitive to these 80 million strong "Generation We" people who care more about walkability and lifestyle than large colonials on three acres, and so on. The whole drive towards social media's ascendancy in real estate was fueled in part by the insight -- as is clear in the ActiveRain post above -- that these Millenials are the FaceBook generation who are natives of the digital realm. But a couple of recent articles make me wonder just how the Millenials will impact real estate; it may be rather different than what we imagine today.

Millenials: Will They Have The Money?

The first article is a column in the Washington Post by Robert Samuelson, titled, "Will Millennials become the chump generation?":

The deep slump has hit Millennials hard. According to Pew, almost two-fifths of 18- to 29-year-olds (37 percent) are unemployed or out of the labor force, "the highest share . . . in more than three decades." Only 41 percent have a full-time job, down from 50 percent in 2006. Proportionately, more Millennials have recently lost jobs (10 percent) than those over 30 (6 percent). About a third say they're receiving financial help from their families, and 13 percent of 22- to 29-year-olds have moved in with parents after living on their own. The adverse effects could linger. An oft-quoted study by Yale University economist Lisa Kahn found that college graduates entering a labor market with high unemployment receive lower pay and that the pay penalty can last two decades. Writing in the Atlantic, Don Peck argues that many Millennials, overindulged as children and harboring a sense of entitlement, are ill-prepared for a "harsh economic environment." They lack the persistence and imagination to cope well. That indictment may be unfair. My own experience is that Millennial co-workers are diligent, disciplined and determined in the face of frustration. Regardless, more bad news may lie ahead. As baby boomers retire, higher federal spending on Social Security, Medicare and Medicaid may boost Millennials' taxes and squeeze other government programs. It will be harder to start and raise families. (Emphasis mine)

You know what else is going to be harder to do? Qualify for mortgages and buy houses. And in case you think our current recession is just a little trough and we'll get through it and out the other side with enormous growth... well, here's the Atlantic for you with this cheery article titled, "How a New Jobless Era Will Transform America":

But in fact a whole generation of young adults is likely to see its life chances permanently diminished by this recession. Lisa Kahn, an economist at Yale, has studied the impact of recessions on the lifetime earnings of young workers. In one recent study, she followed the career paths of white men who graduated from college between 1979 and 1989. She found that, all else equal, for every one-percentage-point increase in the national unemployment rate, the starting income of new graduates fell by as much as 7 percent; the unluckiest graduates of the decade, who emerged into the teeth of the 1981–82 recession, made roughly 25 percent less in their first year than graduates who stepped into boom times. But what’s truly remarkable is the persistence of the earnings gap. Five, 10, 15 years after graduation, after untold promotions and career changes spanning booms and busts, the unlucky graduates never closed the gap. Seventeen years after graduation, those who had entered the workforce during inhospitable times were still earning 10 percent less on average than those who had emerged into a more bountiful climate. (Emphasis added)

Hmm... so 2 out of 5 of the Millenials are unemployed, 13% are living with Mom and Dad, and 6 out of 10 don't have fulltime jobs. And that gap is going to follow them through their entire life. The recession we're in now is looking like it'll make 1981-82 look like the Roaring Twenties. Our financial system is still in shambles, housing market is nowhere close to being out of the worst of the worst with anywhere from 1.7m to 7m in the "shadow inventory" while banks play "extend and pretend" games, private sector hiring is basically zero, and the real unemployment rate might be closer to 15% than it is to 10% once you take into account (a) those who simply have given up looking for a job, (b) the underemployed forced into part-time and temp work, and (c) the Census Bureau related hiring that won't last past mid-2010. For a generation raised in an era of 5% unemployment, bombarded by ads like this one from CareerBuilder, the new reality of employment in the '10s is going to be a harsh one. Forget buying a house; I don't know if the majority of the Millenials can afford to rent an apartment.

Millenials: Stuck With The Check?

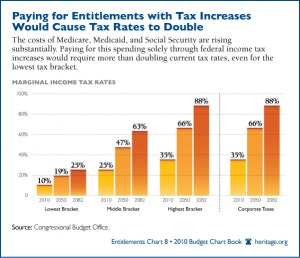

Add to that dismal news the undeniable fact that as the Boomers retire, the nation is going to have to confront some serious issues with entitlement spending. Robert Samuelson is being cute when he writes "As baby boomers retire, higher federal spending on Social Security, Medicare and Medicaid may boost Millennials' taxes and squeeze other government programs." There ain't no "may" about it; it's gonna happen, barring some miraculous unforeseeable event. The Heritage Foundation estimates that tax rates would double by 2050 under current law, even for the lowest level. Here's a handy graphic:

Let's assume anyone in the lowest bracket isn't going to be buying houses anytime soon, unless we return to the days of the NINJA mortgages... which we're probably not going to see again in our lifetimes. So today's unemployed and underemployed Millenials, who are going to make less money over time, will also face rising taxes. This being 2010, the 20 year old college junior isn't thinking about buying a house. By 2025, the 35 year old newlywed might be. 33% over 40 years at the top bracket... let's just say it's a 8.25% per decade increase? So they might be looking at 47.4% in Federal taxes alone if they're in the top bracket? And that's without any other government spending programs between now and 2025, like nationalized healthcare and Cap & Trade -- both of which Millenials support, generally speaking.

Well, People Will Buy Homes

Of course people will buy homes. The economy will eventually turn. Today's slackoisie Millenial will learn some hard lessons about life, and become productive hardworking thirtysomething, get married, have kids, and think about buying a house. When they do, we all assume that they'll be flocking to the Interwebs, to Facebook, to Twitter, to social engagement, to their 4G wi-max third-generation iPads, to find that eco-friendly green condo in the cool "community" areas like the Upper West Side of Manhattan (as the AIA post above suggests), and so on. And some will, no doubt. But the gloomy economic picture suggests an alternative impact of Millenials on real estate.

Once the Millenial finds the condo of his dreams on his 4G iPad and contacts the realtor via Twitter, we may find that due to his lowered earning potential from the lingering effects of the Great Recession of 2009-2014, combined with the fact that he's paying 65% in combined local, State and Federal taxes, not to mention the banks refusing to lend to anyone who can't put down 30% and has a FICO above 750, he can't actually qualify for the mortgage. Lower your sights, young man. That New Urbanism looks fantastic, and it's the lifestyle you really want, but sadly, all you can afford is a $200,000 fixer-upper somewhere in the shadows of Giant Stadium with a 45 minute commute to your not-so-grand job in some corporation you used to rail against as a college student as evil, greedy corrupter of the environment. And realtors everywhere may suddenly discover the incredible allure of Gen-X and the Post-Millenials....

On the Other Hand...

Detroit and Camden may be revived thanks to Millenials! They're walkable cities with cheap housing available. So there is that. I know, I know -- I'm being entirely too gloomy and pessimistic. But tell me, from the evidence we have to date, what gives you such optimism about the Millenials as the Future of Real Estate? -rsh

Edit: Replaced a broken image link on 3/13/10.